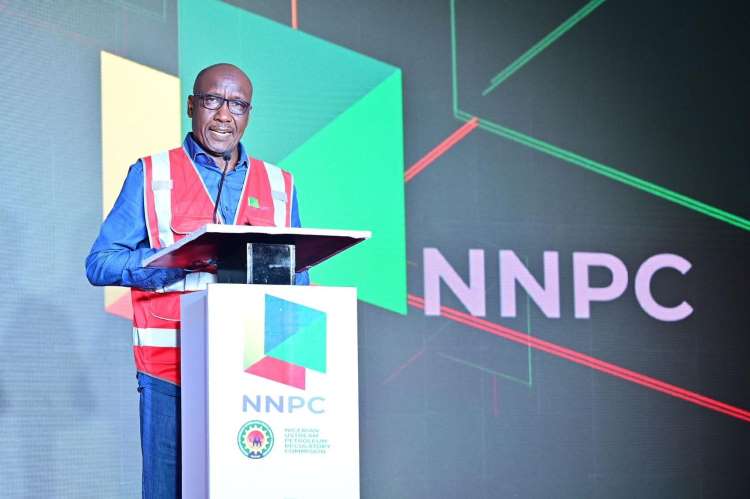

NNPCL GCEO, Mele Kyari

The Nigerian National Petroleum Company (NNPC) Limited says its decision to limit its equity participation in the Dangote Petroleum Refinery was made months ago.

In a statement on Sunday, Femi Soneye, NNPC’s spokesperson, said the national oil firm periodically evaluates its investment portfolio to make sure it is in line with the company’s strategic objectives.

On Sunday, Aliko Dangote, Africa’s richest person, said the NNPC no longer owns 20 percent stake in his refinery.

Dangote said NNPC now owns 7.2 percent of the refinery over failure to pay the balance of their share, which was due in June.

In response, Soneye said Dangote refinery was informed several months prior of NNPC’s decision to limit its equity participation at the paid-up amount.

“NNPC Limited periodically assesses its investment portfolio to ensure alignment with the company’s strategic goals,” he said.

“The decision to cap its equity participation at the paid-up sum was made and communicated to Dangote Refinery several months ago.”

In September 2021, NNPC acquired a 20 percent interest in Dangote refinery for $2.76 billion.

Revealing details of the transaction, NNPC, in its audited financial statements for 2022, said NNPC Greenfield holds the investment.

NNPC said the balance ($1.76 billion) of the cost of equity investments made in Dangote refinery would be paid upon completion of the refinery project or any other date agreed.

Dangote refinery commenced production on January 12.