The Central Bank of Nigeria (CBN), has withdrawn the operating licenses of 2,698 Bureau de Change (BDC) operators, and released a list of dealers it approved.

According to the fresh list published by the apex bank, the total number of approved BDC dealers were reduced to 2,991.

The document titled ‘Approved BDCs’, revealed that the licenses of 2,698 BDCs have been withdrawn.

In 2022, the Central Bank published similar list in a document with reference: REF: FPR/DIR/PUB/CIR/001/037, titled, ‘List of CBN Licensed Bureaux De Change As at December 31, 2021’ where the CBN had approved 5,689 black market dealers.

BDCs in Nigeria are the major influencers of exchange rate.

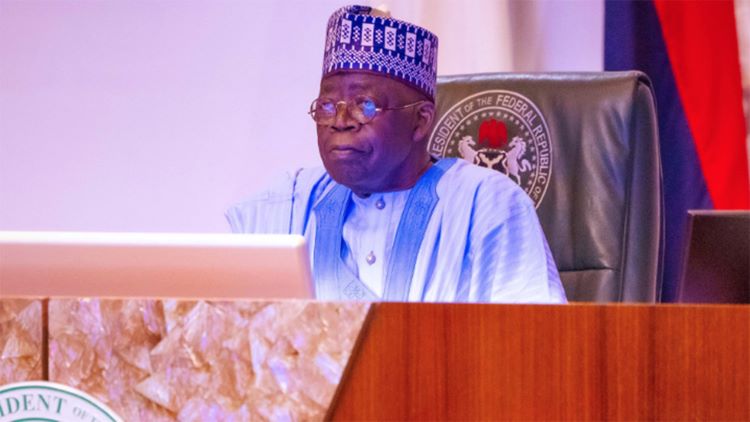

Prior to the Bola Tinubu era, the operators had grown from 74 in 2005 to 5,689 in 2021.

The BDCs grew by more than 100 per cent under Emefiele who later banned the sale of foreign exchange to BDCs over round tripping and involvement in illegal financial flows.

Under Tinubu, a document titled, ‘Policy Advisory Council Report: National Economy Sub-committee’, advised implementation of key reforms like raising the capitalisation for BDC operators.

Another suggestion by the council was for the CBN to allow the Nigerian banks to operate as the primary dealers to supply the forex market.

Since the naira was floated by the CBN in June, the currency has fallen to N795.28 at the Investors’ and Exporters’ FX window.

The situation is worse at the parallel market where it closed at N820 per dollar, the British pounds closed N1095 and the Euro N905.

In a recent statement by the President of the Association of Bureau De Change Operators of Nigeria (ABCON), Aminu Gwadebe, he said the FX market would remain volatile because BDCs are excluded from the I&E window.

’The volatility of the naira continues to underpin the slow economic growth of Nigeria. The I&E window is laudable, it’s patriotic and nationalistic, but there is no policy that can actualize its mission without carrying the interest of the subsector (which is the BDCs).

“The I&E window is supposed to run on three legs, the banks, the CBN and the BDCs, overtly or covertly, the BDCs are missing,’’ said Gwadabe.