The International Monetary Fund, IMF, has downgraded Nigeria’s Gross Domestic Product (GDP) growth for 2024 to 3.1 per cent as businesses shut down factories over harsh economic environment.

The Washington-based institution had projected Nigeria’s economy to grow by 3.3 per cent in 2024.

But in its new World Economic Outlook for July 2024, the lender said the downgrade was as a result of a slowdown in economic activities recorded in the first quarter of the year.

“The forecast for growth in sub-Saharan Africa is revised downward, mainly as a result of a 0.2 percentage point downward revision to the growth outlook in Nigeria amid weaker than expected activity in the first quarter of this year,” IMF said.

In the first quarter of 2024, Nigeria’s GDP growth declined to 2.98 per cent, lower than the rate recorded in the fourth quarter of 2023 which was 3.46 per cent.

Reforms in Nigeria which led to the removal of fuel subsidy and floating of the currency have made it difficult for manufacturers and traders in the country.

Access to foreign exchange has worsened despite the Central Bank of Nigeria’s intervention in the foreign exchange market.

As of June 2024, inflation in Africa’s biggest economy rose to 34.19 per cent while food inflation hit all-time-high of 40.8 per cent.

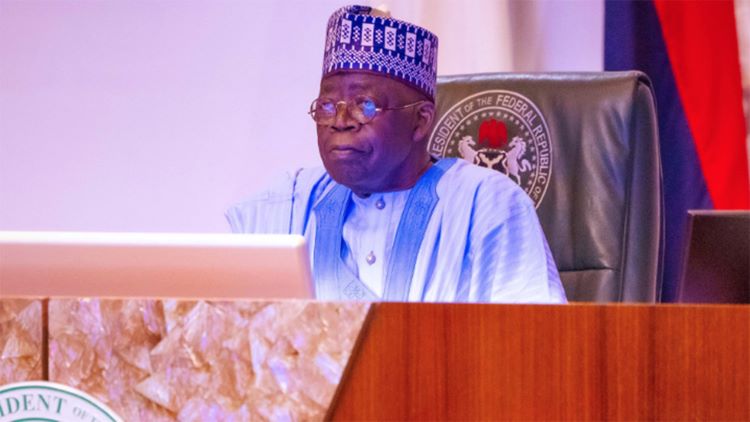

The Manufacturers Association of Nigeria said that 767 manufacturers shut down operations while 335 became distressed in 2023 after President Bola Ahmed Tinubu began his reform.

However, the lender retained its global economic forecast, which was held in April.

It said growth is expected to remain stable at 3.2 percent in 2024 and 3.3 percent in 2025.

“The forecast for global economic growth is broadly unchanged from that in April,” IMF said.

IMF also projected that global inflation will continue to decline.

The lender said global inflation will slow to 5.9 per cent this year from 6.7 per cent last year, a position it held in April.

“Inflation is expected to remain higher in emerging market and developing economies (and to drop more slowly) than in advanced economies. However, partly thanks to falling energy prices, inflation is already close to pre-pandemic levels for the median emerging market and developing economy,” IMF said.