Naira and Dollar

The Nigerian Federal Government is planning to raise $10bn to improve liquidity in the foreign exchange market. On Tuesday, the naira fell to an all-time low of 1,850 per dollar at the parallel market.

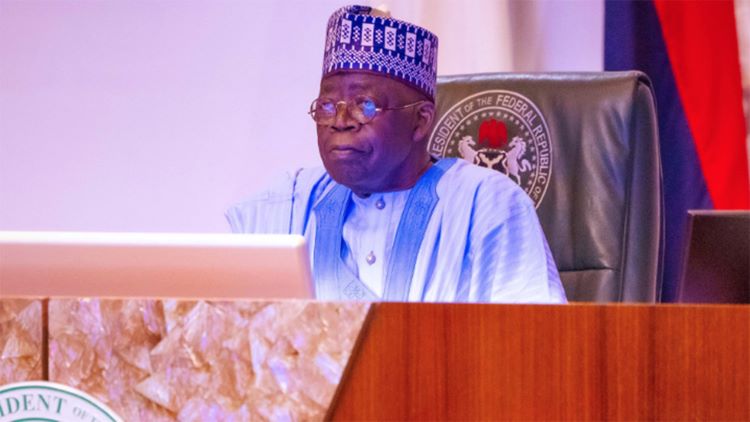

President Bola Tinubu, who was represented by Vice President Kashim Shettima, disclosed this at the inaugural Public Wealth Management Conference in Abuja on Tuesday.

The Ministry of Finance Incorporated organised the event with the theme “Championing Nigeria’s Economic Prosperity”.

In a statement on Tuesday, the Senior Special Assistant to the President on Media & Communications, Stanley Nkwocha explained, “The Federal Government set a goal to raise at least $10bn in order to increase foreign exchange liquidity, a key ingredient to stabilise the naira and grow the economy.

“At the core of this is ensuring optimal management of the assets and investments of the Federal Government towards unlocking their revenue potential. This includes our bold and achievable plan to double the GDP growth rate and significantly increase the GDP base over the next 8 years.”

The President further emphasised transparency and accountability as key principles, believing that improved corporate governance, innovative partnerships, and attracting alternative investment capital would significantly increase returns.

He noted that these improved returns will then be directed towards “crucial funding for education, healthcare, housing, power, roads and other areas vital to lifting millions out of poverty and stimulating sustainable economic development and job creation for the youth”.

Meanwhile, The PUNCH learnt that exchange rate volatility continued across the country on Tuesday despite the heavy presence of security personnel at the Wuse Zone 4 currency market in Abuja.

Currency traders in Abuja quoted the buying price of the dollar at 1,820/$ and the selling price at 1,850/$, leaving a profit margin of 30.

However, the naira appreciated by 1.48 per cent to 1,551/$ at the official market, following an improved forex turnover of $117.32m.

This came after the local weakened for three consecutive days at the Nigerian Autonomous Foreign Exchange.